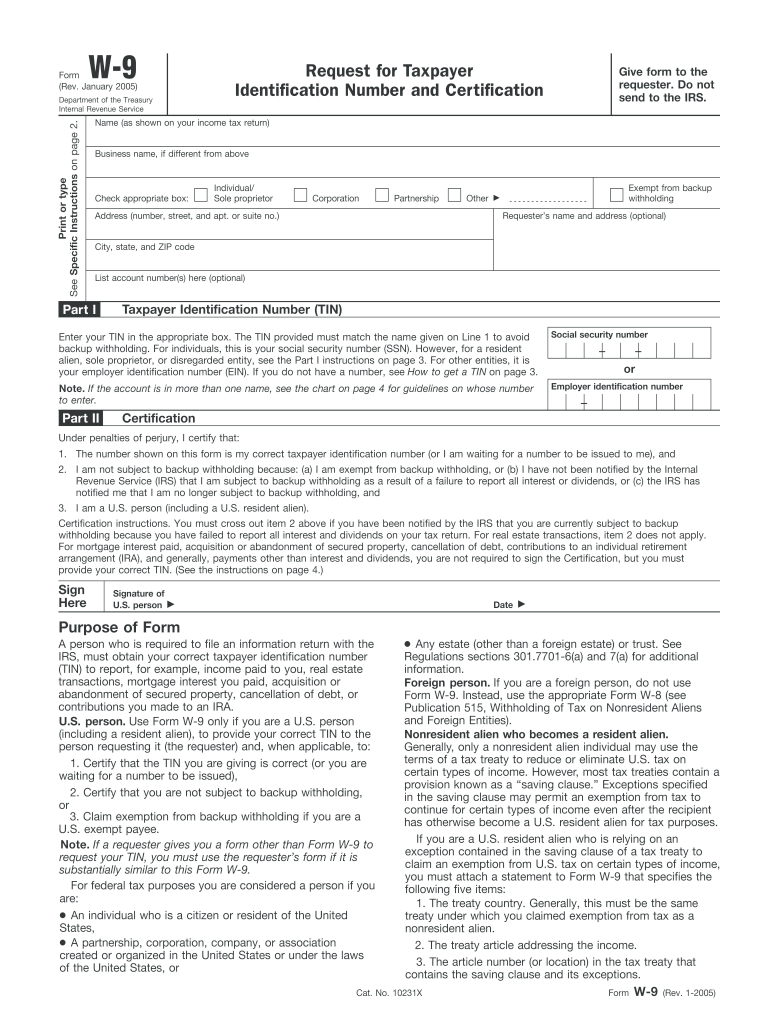

If you do not return Form W-9 to the requester with a TIN, you might be subject to backup withholding.

W 9 pdf signature code#

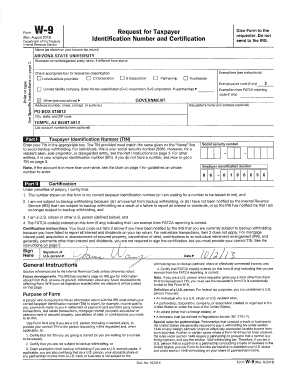

This will ensure that payments you receive are properly reported to the IRS. person aa Date General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Once again, make sure you provide accurate information on your W-9.

This enables a quick access whenever you need them. You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise. A minor cannot sign a contract, but the W-. View W9-23CC5-11.pdf from MATH 688 at High Point University. Daymond John, star of Shark Tank, discusses boosting your business with both human and high-tech touches throughout the customer journey. person, or resident alien, sign Form W-9. The signature can be either the minors signature or the legal guardians (parent or court appointed legal guardian). More than a million customers and a billion users trust DocuSign with their critical and essential agreements. To establish to the withholding agent that you are a U.S. Keep all the forms in one place, for example in PDF Expert on your iPad. The instructions for Form W-9 include a specific section related to the signature (certification) requirements. Make sure your mailing address is correct, otherwise you will not receive your 1099-MISC form later. Remember, your customer has no way to verify that you've entered the correct details on your W-9 form. Same thing may happen if you make a typo in the SSN or EIN. Mistyping your name or DBA on the W-9 can actually trigger an audit since it would appear to IRS that you didn't report your form 1099-MISC when you submit your tax return later. We have prepared a list of common mistakes to avoid while you are filling out your Form W-9.

Many have found this out the hard way - even a small typo in any of the fields could cost you big. Form W-9 is officially titled Request for Taxpayer Identification Number and Certification. The W-9, or Request for Taxpayer Identification Number and Certification form, will provide the employer with personal information such as the employees name, address, social security number, and more. However, mistakes on your tax returns can prove to be costly.

0 kommentar(er)

0 kommentar(er)